An SIP allows you to invest a fixed amount regularly (monthly/quarterly) into a mutual fund scheme. It promotes disciplined investing, rupee cost averaging, and helps build long-term wealth.

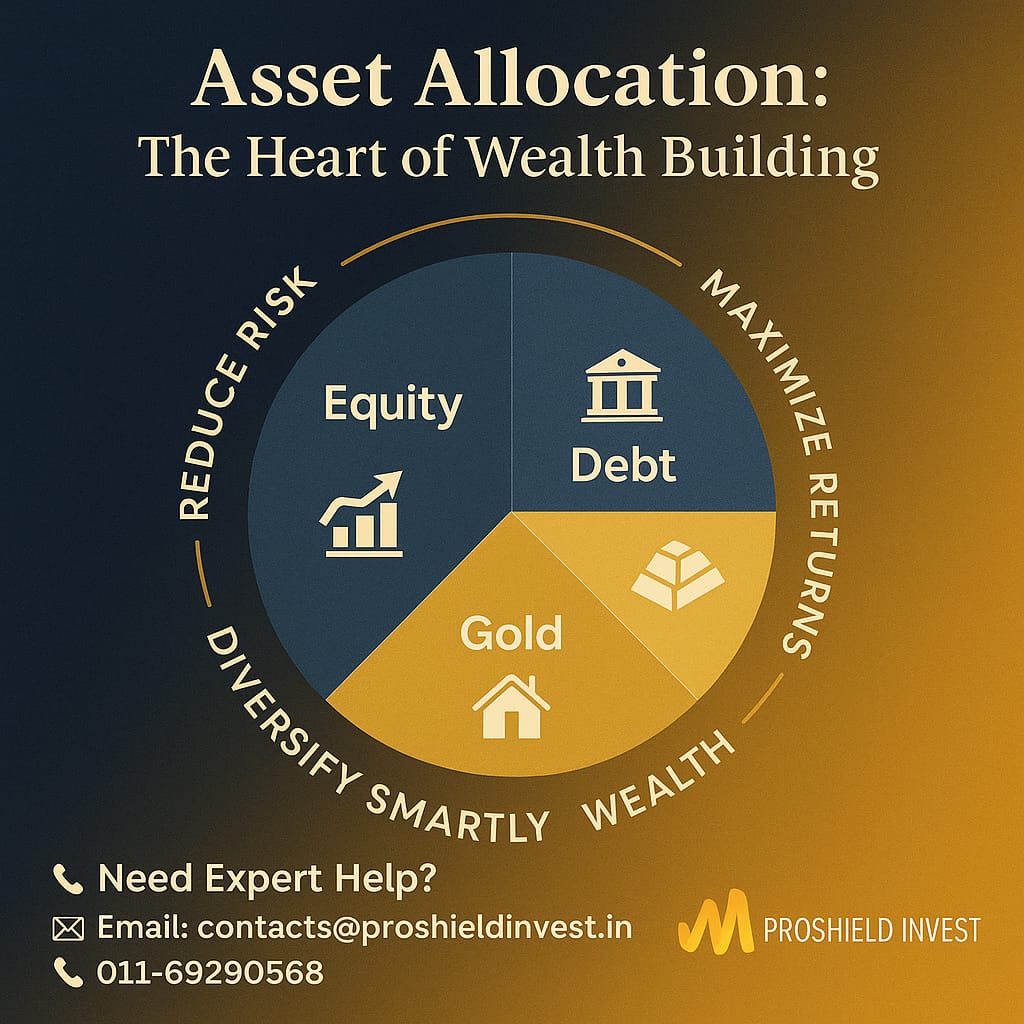

The Importance of Diversification

Discover how mutual fund diversification balances your investments, reduces risk, and helps you build long-term wealth effectively.

Smart Risk Management

Diversifying across sectors and asset types, mutual funds minimize losses and align with your risk profile—ensuring disciplined and safer investing.

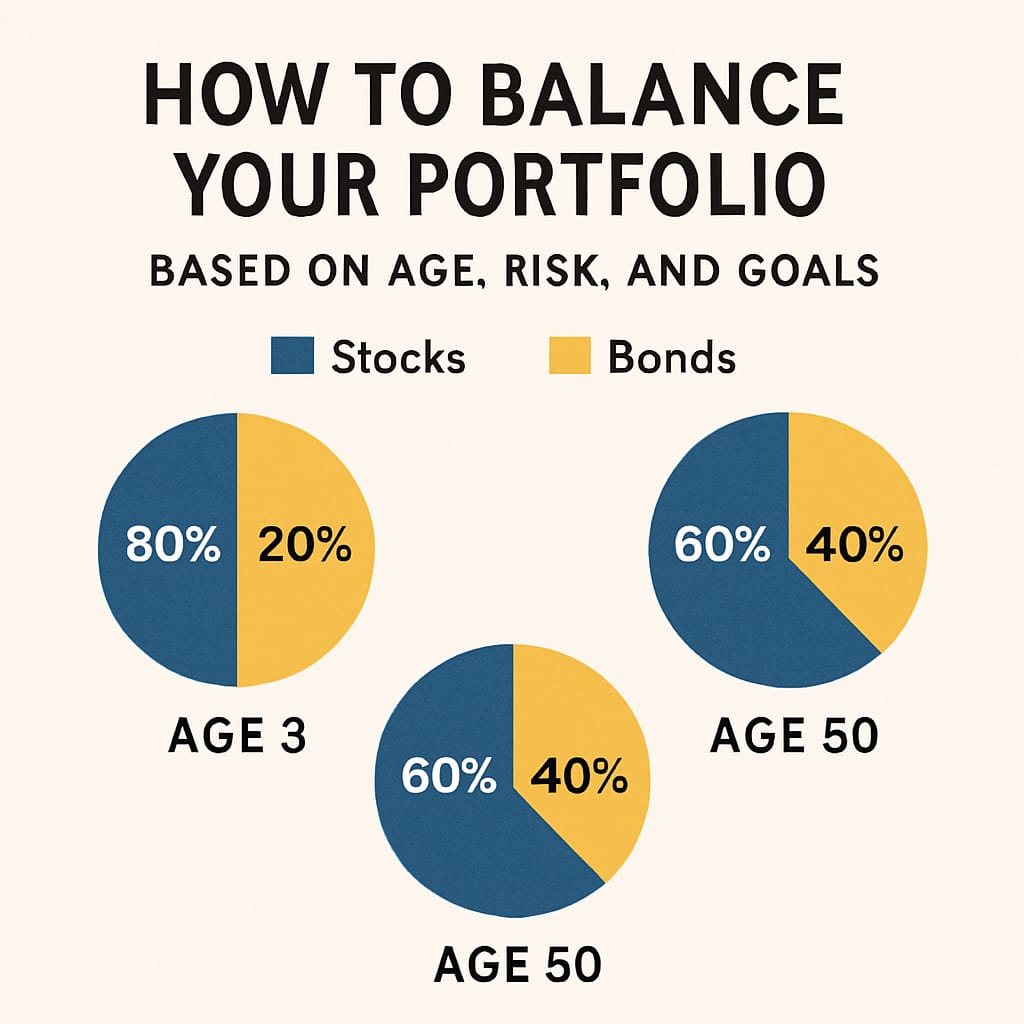

Minimize Market Volatility

Through SIPs, asset allocation, and diversification, mutual funds smoothen market fluctuations, helping you stay calm and focused on your goals.

Boost Long-Term Returns

Invest early, stay consistent. Mutual funds harness compounding and market growth to enhance your returns over time with managed risk.

Preserve and Protect Your Capital

Mutual funds safeguard your money with professional management, conservative strategies, and thoughtful diversification.

Unlock Growth Potential

With access to diverse sectors and compounding benefits, mutual funds create strong opportunities for capital growth and wealth creation.

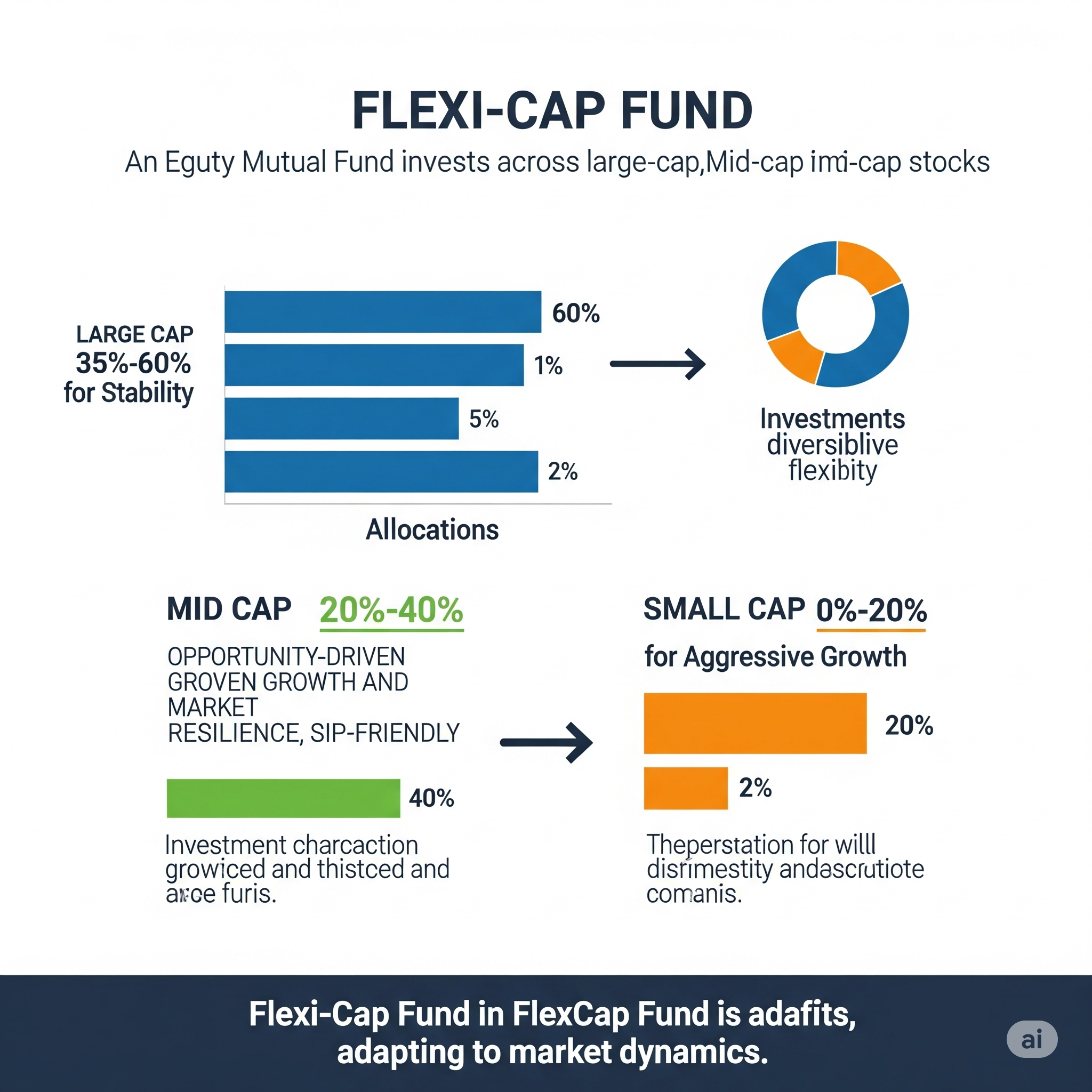

Stay Ahead with Market Adaptability

Active fund management and flexible allocation let mutual funds adjust with market trends—keeping your investments on track.

Diversify with Confidence

Mutual funds offer a stable, growth-oriented path through professional, diversified, and adaptive investing strategies.